Table Of Content

Check out some of our best HELOC lenders to start your search for the right loan for you. You’ll then need to input your current mortgage balance and current value of your home, plus more information depending on your refinance goal. Your credit score and whether or not you’re a veteran will both influence your refinance options.

You learn about rates

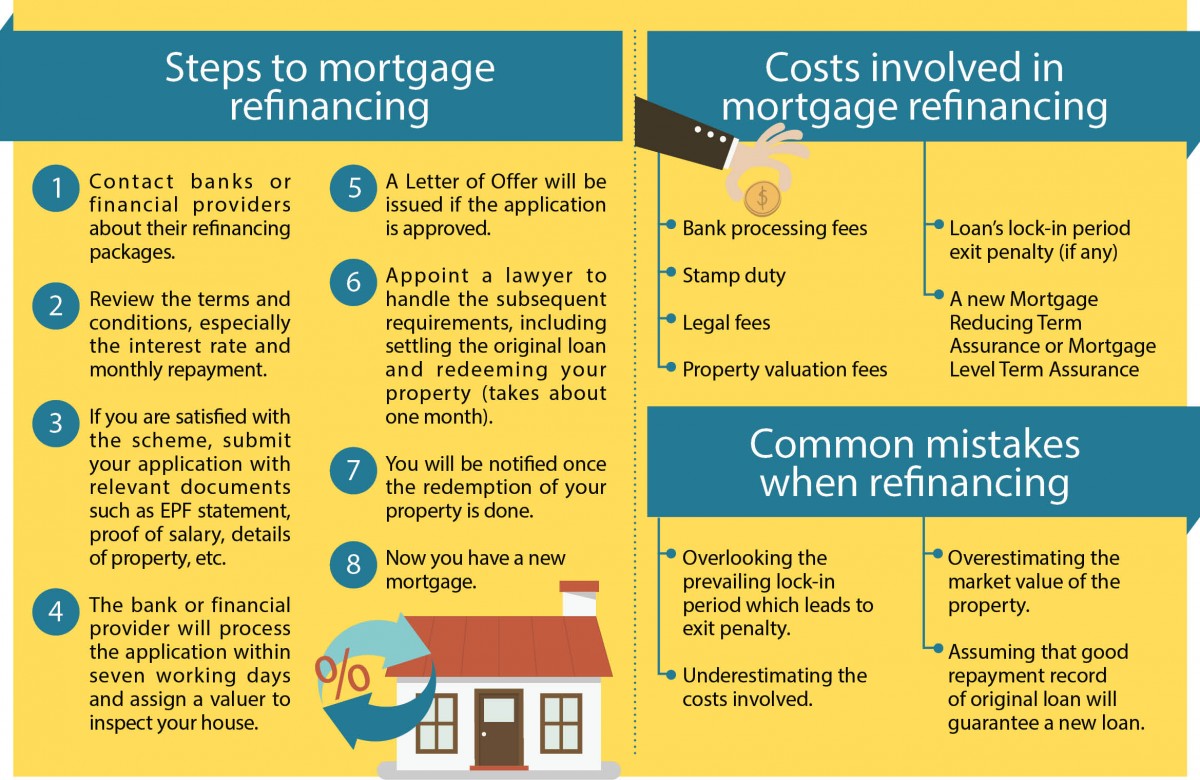

When your lender finishes underwriting your loan and reviewing your appraisal, they’ll send you a document called a Closing Disclosure. Your Closing Disclosure includes the final terms of your loan, your closing costs, your interest rate and more. Your lender must give you at least 3 days to review your Disclosure after you receive it. Your lender might offer you a refinance without closing costs if you can’t afford to pay those expenses.

Can I refinance a mortgage with bad credit?

Instead of the lender paying the home’s seller, it pays off the balance of your old home loan. You’ll pay the lender back based on the amount of your new mortgage. In some cases, you can get a no-closing-cost refinance so you don’t have to bring any money to the table. Be aware that closing cost is then paid over the life of the loan in the form of a higher rate.

Should You Refinance Halfway Through Your Mortgage? - Bankrate.com

Should You Refinance Halfway Through Your Mortgage?.

Posted: Fri, 19 Apr 2024 07:00:00 GMT [source]

What are current refinance rates?

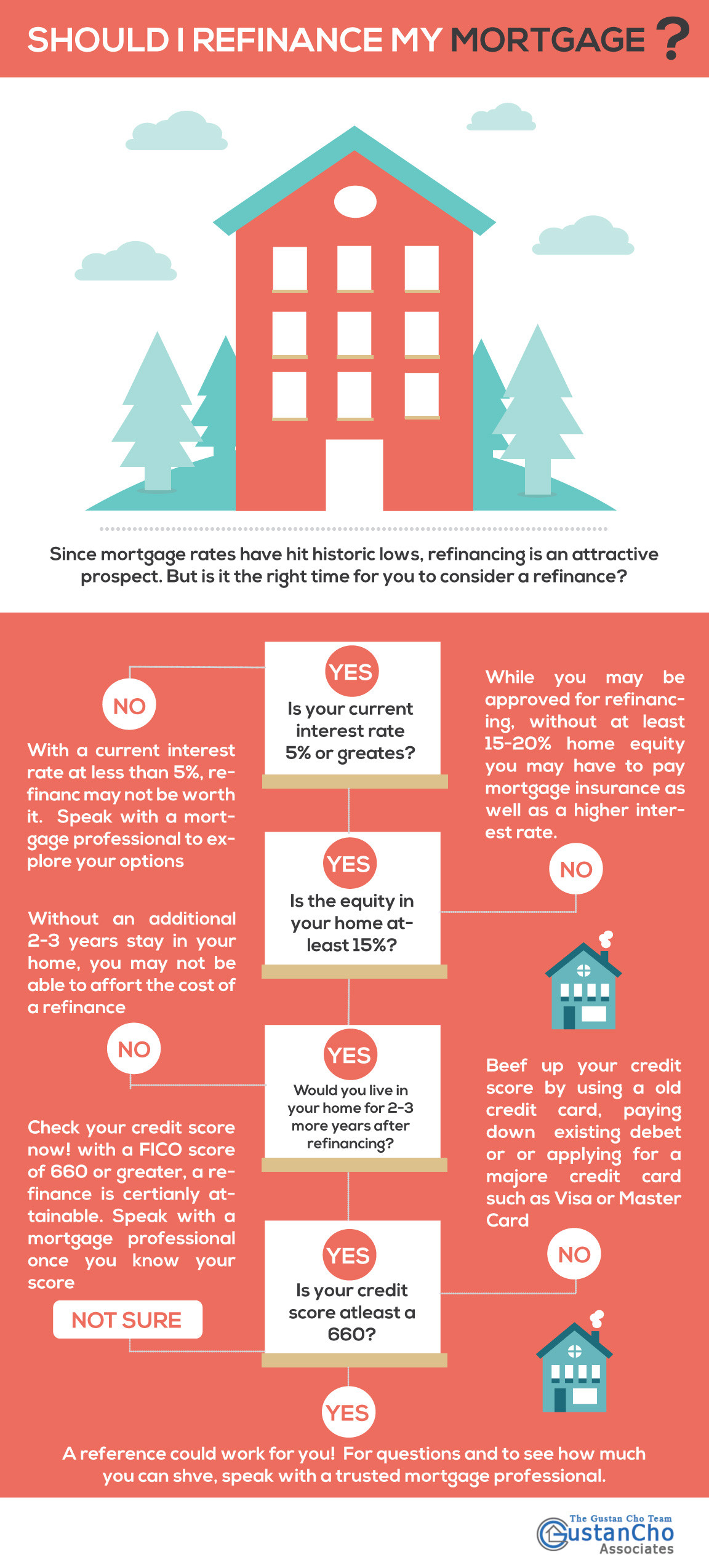

You might be able to refinance your FHA loan to a conventional loan and stop paying a mortgage insurance premium (MIP). But the upfront costs required for refinancing may mean the lower monthly payment isn’t worth your while. That’s why it’s important to understand the refinancing process and make sure it’s the right move for you. The time it takes to refinance a mortgage loan varies depending on the lender, the type of refinance loan and how prepared you are in advance. For a VA loan refinance, you have to wait 210 days after the first monthly payment of your existing mortgage. The break-even point on a mortgage is the date on which you fully recover your refinance closing costs and begin to benefit from your new lower payment.

How soon after closing can I refinance?

With a cash-out refinance, you’ll tap into your equity with a new loan that’s bigger than your existing mortgage balance, allowing you to pocket the difference in cash. The loan-to-value ratio measures the amount of financing used to buy a home relative to the value of the home. If you plan to stay in the home for an extended period, getting the lowest mortgage rate can be more important than paying the lowest closing costs. Bankrate has helped people make smarter financial decisions for 40+ years.

A refinance may not be worth it — or even possible — if your credit, income, savings and home equity aren’t in order. A reverse mortgage is technically a type of refinancing option for borrowers over the age of 62 with sufficient equity in their homes. Borrowers who switch to a reverse mortgage don't have to make payments on their loan while they’re alive.

Does refinancing a mortgage hurt your credit?

Will Interest Rates Go Down in May 2024? Mortgage Rates Forecast - The Mortgage Reports

Will Interest Rates Go Down in May 2024? Mortgage Rates Forecast.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

For example, if you only expect to own the home for a few more years, you likely won’t save enough on mortgage payments to justify the costs of refinancing. It may also not be worth refinancing if the total costs and fees result in a significant blow to your finances. Mortgage points are a type of prepaid interest that you can pay upfront — often as part of your closing costs — for a lower overall interest rate. If you’re looking to lower your monthly payments, shrink your interest rate, shorten the term of your loan or change your loan type, a refinance could be the right move for you. A vast majority of US homeowners already have mortgages with a rate below 6%. When you refinance, you apply for a new mortgage to pay off your current one.

Calculate your break-even point — if you’ll be in your home long enough to recoup the costs, the refinance probably makes sense. You’ll typically pay between 2% and 6% of your loan amount toward closing costs. However, the shorter the lock, the better the rate, so get your paperwork in quickly and stay in contact with your loan officer during the refinance process.

Should You Refinance Your Mortgage?

It’s important to understand that while you shop for rates, you’ll want to have all lenders submit their inquiries within the same time span. Credit bureaus will view several inquiries as one if they fall within a 14- to 45-day period. If you have multiple hard inquiries spread over a longer period of time, your score will likely drop more drastically. In some states, borrowers are required to have a lawyer review documents before closing when refinancing a mortgage. However, you may decide to hire a real estate attorney who can protect your interests and help guide you through the refinancing process even if you live in a state where it’s not a requirement.

The size of the mortgage loan remains the same with a rate-and-term refinance. But depending on the changes made to the loan, you could potentially end up with lower monthly mortgage payments or pay down your mortgage faster than you’d originally planned. With that said, you might not know which type of refinancing will best suit your needs. As a homeowner, refinancing a mortgage loan can be an important financial decision. Whether you’re looking to lower your monthly mortgage payment or take cash out against your home’s equity, applying for a refinance can help you reach certain milestones and achieve your personal goals.

As the city's tourism and business travel rebound post-pandemic, the hotel is capitalizing on its location and unique offerings. Various amenities, from The Stayton Room bar and restaurant to 3,000 square feet of meeting space, cater to business and leisure travelers. On-property retail amenities such as Crunch Fitness and Starbucks further enhance the experience.

However, submitting multiple mortgage applications in an effort to get the lowest rate possible won’t hurt your score. Once you’ve decided that refinancing makes sense for you, learn more about how to refinance your mortgage. Also, explore the hidden fees to watch out for when refinancing your loan. As you move the slider left and right, the calculator updates your total savings over the indicated number of years.

She has a passion for teaching others about better living through improving your finances. While the housing market is still currently pretty lousy overall, it's definitely tipped in favor of sellers, not buyers. Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers.

That's the point at which the money you're saving with the new loan begins to exceed the amount you had to pay in upfront closing costs. Breaking even can take months or even years, so refinancing may not be a wise move if you don't expect to stay in your home for that long. Getting quotes from at least three mortgage lenders can help you maximize your savings when refinancing a mortgage. Once you’ve chosen a lender, discuss when it’s best to lock in your rate so you won’t have to worry about rates climbing before your refinance closes. For most borrowers, the current high-rate environment is not an ideal climate for replacing a loan with a new one.

No comments:

Post a Comment